If you also need ICICI Platinum Credit Card, then you must read this post of ours and after reading you will know whether you are eligible to take this card or not.

icici platinum credit card charges All the information and four about which we are going to provide you complete information.

The Amazon Pay ICICI credit card is also good if you have one. You can also take this as there are many sales where you only need ICICI credit card. But if you use ICICI credit card on Amazon there. Then you do not get that much benefit there. For the same reason if you have ICICI Amazon Pay credit card. Even then you can take it because there are many benefits of this card and no annual charge is taken for this card and there is no extra charge for this card.

If you want to get free sample product then you must follow this post :- free sample product

ICICI Platinum Credit Card Many Benefits

ICICI Bank Platinum Chip Credit Card Benefits If you are not able to get credit card of any company. Then you must definitely take this credit card because you have a lot of benefit by taking this card. This will also increase your civil score and there is no charge for it. That’s why you must use this card.

And as long as you use this ICICI Platinum Credit Card, you will not be charged any extra charges of any kind in any year for the number of years. There is no annual charge in this and there are frequent sales on many sites, using which you can take advantage of this offer and your civil in ICICI credit card will keep increasing.

The older your credit card is, the more transactions you do, the higher your civil score will go up.

You must know about the Civil Score, which increases your credit score and has many benefits. Anytime you want to take loan or credit card. By going there, you can easily take any loan or any credit card in any bank?

I Told You As Much Information As I Had About Icici Platinum Credit Card Benefits And Charges And For More Information, You Can Go To Their Site And Get More Information There And If You Want To Get More Information, Then You Can Talk To Their Customer Care Support. Can Do

How to Apply Icici Credit Card Without Income Proof

Applying for ICICI Platinum Credit Card is very simple. You don’t have to do anything. Just follow some of our mentioned steps and after that your one application will be successfully applied.

Steps 1. First of all, by clicking on the link of the ICICI Platinum credit card that I have given you, you have to go to their official site by clicking on the link from that credit card.

After clicking on the link, you will come to their official site and here you will have to fill some of your information such as your address and mobile number and name, email id of PAN card, after filling all these information, you will have to click on the option of Agree. Click submit and submit your information.

- City (Pick from our list) your city name

- Date Date of Birth

- Salaried

- Monthly take home salary

- Salary Mode

- Pancard No.

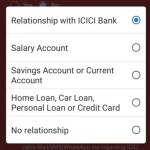

- Relationship with ICICI Bank

- Name

- Email ID

- Mobile Number

- Company (Pick from our list)

After entering the mobile number, you will be asked whether you are self-employed or a salaried person, then you have to click on the salary and here your income will be asked for this last year. There you have to fill above 2.5 lakh like you can fill three lakh 400000 and after that you have to submit after entering your PAN card number.

And there is another option where you will be asked whether you are an old customer of ICICI or not. You have to select both there. If you are not a customer, then if you are a customer, then you have to move forward by selecting the region there.

An OTP will come on the mobile number which you have entered. That OTP has to be verified.

After verifying the OTP, if such an interface comes in front of you that the conversion you have to eligible . Applying for ICICI Platinum Credit Card

If such option comes in front of you that you are invisible to take ICICI Platinum Credit Card then you have to wait for few days. Whatever your information is, ICICI Bank has already been sent and they will contact you within a day or two and will process your application after taking KYC documents from you and after that

Your credit card will be delivered to you within 1 week and the tracking service details will be submitted to you within a day or two. How can you track where your application has reached now?

If your form is rejected then you will get an interface like this.

What should you do now? If you want to take this ICICI credit card then you have to go to your nearest branch for that.

And after going there, you will have to open one of your savings account and come. You will have to make a fixed deposit of the amount of credit card limit you want to keep in it and after that you will be given this credit card. Within 1 week!

And whatever amount you fix, you will be given a percentage of 4.9% or more. Every year like you fix your amount anywhere. There you are given some percentage of this. In the same way, here also you will be given a percentage and all the fixed deposits you have made in this ICICI savings account will be your limit on your credit card.

Benefit of ICICI Platinum credit card

And if you do not want to use this card, then you should use this card for at least 3 or 6 months and after that you can update this credit card to Amazon Pay ICICI credit card. There will be no charge for that and you know about Amazon Pay credit card, how many benefits do you have in it?

1 thought on “ICICI Bank Platinum Chip Credit Card Apply Online | How To Apply Icici Credit Card”